NAB: Financial Well‑being Tools → Saving Spaces

As lead product designer, I redesigned and scaled two financial wellbeing features—Saving Spaces and Budgets—within NAB’s mobile app, empowering over 6 million active users to set savings goals and track spending more effectively.

TLDR

Role: Lead Product Designer

Collaborators: Alex (PD), Lisa (PO), Nathan (PD)

Scope: Saving Spaces (up to 30 buckets) + Budgets tracking

Impact: Empowered users to design multi-goal savings and managed budgets—boosting both user satisfaction and savings account engagement.

The Challenge & Strategic Goals

Enable customers to save for multiple goals simultaneously using existing NAB savings accounts.

Help customers set and manage budgets for recurring and discretionary spending.

Increase engagement and promote healthier money habits via intuitive UX.

My Role & Responsibilities

Owned end-to-end design for Saving Spaces and Budget tools within the NAB app.

Conducted user research (interviews, usability tests) targeting users struggling to achieve saving goals or stay within budget.

Defined feature flows, wireframes, and high-fidelity UI design.

Collaborated closely with PMs, engineers, and compliance teams to ensure regulatory alignment.

Designed interactive prototypes for key flows: creating a Space, moving money between Spaces, setting budget targets.

Mentored designers and contributed to NAB’s design system library.

Key Research & Design Decisions

User Research & Discovery

Conducted interviews and usability testing with digitally engaged NAB customers aged 25–45.

Key insights:

Users struggled with manual savings discipline.

There was strong demand for multi-goal tracking.

Automated saving felt like “set and forget” confidence.

Feature Flows

Designed contextual entry points to Spaces from the main savings account screen.

Introduced frictionless flows: 3-tap setup, inline editing, nudges to complete goal setup.

Automation UI

Explored 3 models for rule setup: sliders, percentage-based inputs, and preset templates.

Selected percentage allocation UI as the clearest mental model for recurring deposits.

Feedback & Iteration

After initial pilot, adjusted default Space names based on most common use cases (Emergency Fund, Holiday, House).

Added progress visualisation and timeline projection to motivate users.

Cross-Functional Collaboration

Co-led fortnightly design huddles with engineering and product to balance feasibility and UX intent.

Created internal confluence docs and walkthroughs to socialize new features across teams (Product, Legal, CX).

Concepts recreated for portfolio purpose. Does not represent the actual product.

Strategic Impact & Business Outcomes

Nearly 27,000 Spaces created within a month of customer roll-out

First 3 months: 80k+ Spaces created, 97M+ deposits.

Positioned NAB as a leader in mobile-first financial wellbeing tools, improving customer satisfaction and digital adoption.

The redesign contributed to higher savings account activity, increased transfer velocity, and exposure to more NAB savings product offerings .

Anecdotal customer feedback: “I finally feel like my saving plan is realistic and achievable.”

View Spaces in action on nab.com.au website

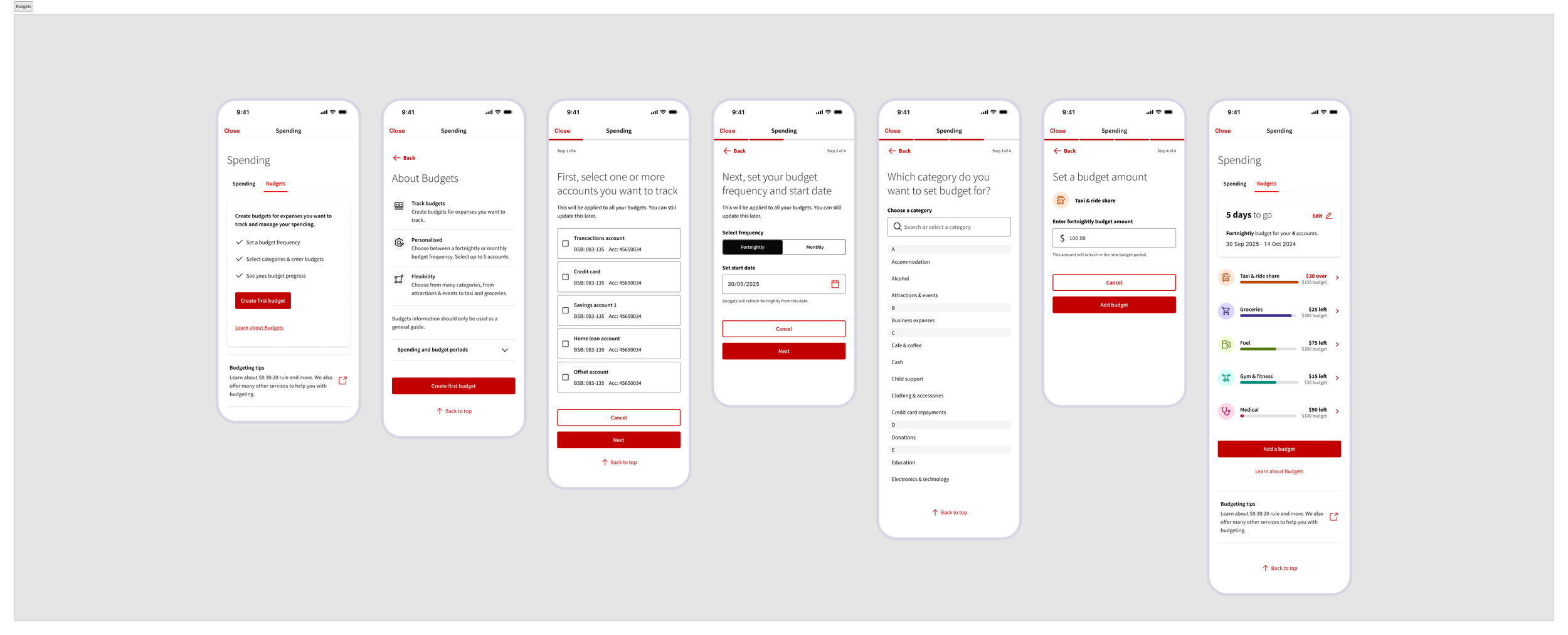

Budgets mini-app

Took over the design work from a colleague and carry forward the design deliverables and dev support till the launch and tracking the success of the budgets feature.

Concepts recreated for portfolio purpose. Does not represent the actual product.